Understanding the place of supply is crucial for determining the correct tax liability under GST. When it comes to the transportation of goods, pinpointing the “place of supply” can sometimes be tricky. This article will delve into the specifics of determining the place of supply in case of transportation of goods, providing clear explanations and practical examples to help you navigate this important aspect of GST.

Deciphering the Place of Supply for Goods Transportation

The place of supply for transportation of goods is generally determined by the location of the recipient of the service. This means that the GST liability falls on the state where the person receiving the transportation service is located. This seemingly simple rule has nuances, especially when dealing with different types of transportation scenarios. Let’s break down these different scenarios to gain a clearer understanding.

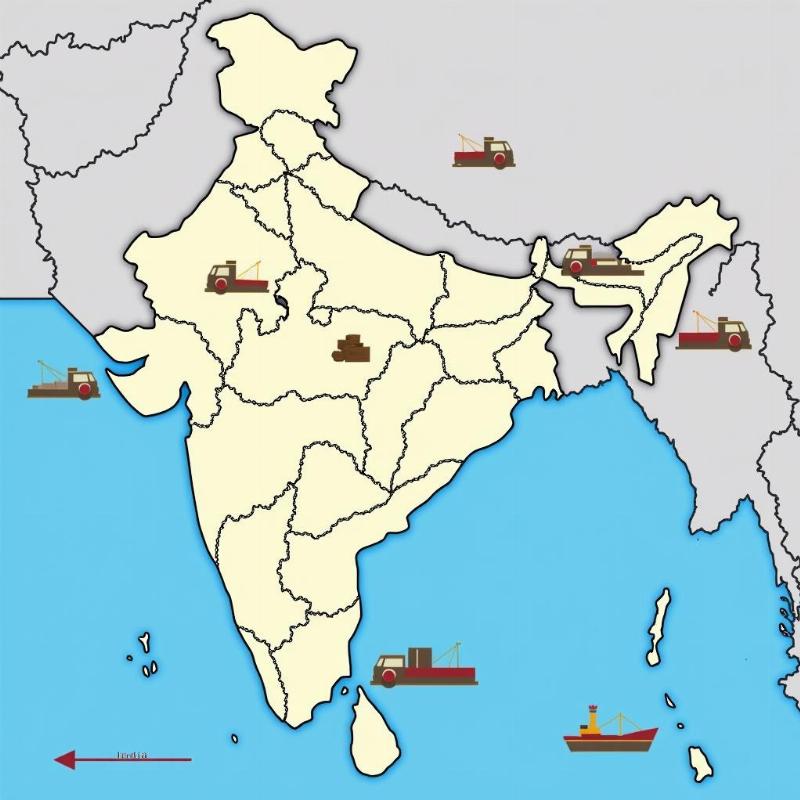

Location of supply for goods transportation

Location of supply for goods transportation

Transportation by Road, Rail, or Air

When goods are transported by road, rail, or air within India, the place of supply is the location of the recipient, as mentioned earlier. For instance, if goods are transported from Mumbai to Delhi, and the recipient is located in Delhi, then the place of supply is Delhi. This is regardless of where the transportation company is based.

Transportation by Sea

Transportation by sea introduces a slight variation. If the transportation is within India, the same principle applies: the recipient’s location is the place of supply. However, for international transportation by sea, the place of supply is the location where the goods are loaded onto the ship for export.

Common Scenarios and FAQs

Understanding the general rule is essential, but applying it to real-world scenarios can be challenging. Let’s explore some common situations:

-

What if the recipient is unregistered under GST? In this case, the place of supply is the location of the supplier of transportation services.

-

What if the goods are transported to multiple locations? The place of supply is determined separately for each leg of the journey based on the location of the recipient for that particular leg.

Expert Insights

Akhil Gupta, a seasoned logistics consultant, suggests, “Businesses involved in transportation should meticulously document the location of their recipients to avoid any confusion regarding GST liability. Clear documentation is crucial for smooth compliance.”

What if the Transportation is Part of a Larger Transaction?

Sometimes, transportation is bundled with other services, like warehousing or packaging. In such cases, the place of supply for the entire transaction is determined based on the principal supply. For example, if transportation is ancillary to a sale of goods, the place of supply for the entire transaction would be the place of supply of the goods.

Conclusion

Determining the place of supply in case of transportation of goods is a crucial aspect of GST compliance. Understanding the general principles and the specific rules for different scenarios is vital for businesses to accurately assess their tax liability. Accurate documentation and a clear understanding of the recipient’s location are paramount for seamless operations under the GST regime. Remember to consult with a tax professional for specific guidance related to your business.

FAQs

- What is the place of supply for goods transported by rail within India? The place of supply is the location of the recipient.

- What if the recipient’s address is unknown? The place of supply defaults to the supplier’s location.

- Does the mode of transport affect the place of supply? While the mode generally doesn’t affect the place of supply within India, international sea transport has a different rule.

- Where can I find more information on GST place of supply rules? Refer to the official GST portal or consult with a tax advisor.

- Is it essential to maintain proper records of the place of supply? Yes, maintaining accurate records is crucial for GST compliance and audits.

- How does the place of supply affect my GST liability? The place of supply determines which state receives the GST collected.

- What happens if I make a mistake in determining the place of supply? This could lead to penalties and interest, so it’s crucial to get it right.

place of supply under gst for services

About PlaTovi: PlaTovi is your one-stop solution for all your travel needs, specializing in crafting unforgettable travel experiences within India and beyond. We offer a comprehensive suite of services, including traditional tour packages, hotel and resort bookings, international and domestic flight bookings, event and wedding planning, car rentals, and airport transfers. Our expertise extends to visa assistance and documentation support, ensuring a hassle-free travel experience. For more information or to book your next adventure, contact us at [email protected] or call us at +91 22-2517-3581.