VFS travel insurance is a crucial aspect of any trip, whether domestic or international. It provides financial protection against unforeseen circumstances, ensuring a smooth and worry-free travel experience. From medical emergencies to lost baggage, having the right VFS travel insurance policy can save you from significant financial burdens and stress. This article will delve into the importance of VFS travel insurance, the different types available, and how to choose the best policy for your needs.

Understanding the Importance of VFS Travel Insurance

Why is VFS travel insurance so important? Imagine a scenario: you’re on your dream vacation in a foreign country, and you suddenly fall ill. Medical expenses abroad can be exorbitant, and without insurance, you could face a hefty bill. VFS travel insurance protects you from such financial shocks. It also covers other potential travel mishaps like flight cancellations, lost luggage, and even trip interruptions. Investing in VFS travel insurance is investing in peace of mind.

Types of VFS Travel Insurance

There are various types of VFS travel insurance policies available, each catering to different needs and budgets. Some common types include:

- Single Trip Insurance: Ideal for single trips, this policy covers you for the duration of your specific travel dates.

- Multi-Trip Insurance: Perfect for frequent travelers, this policy covers multiple trips within a year.

- Family Travel Insurance: Covers all members of a family traveling together.

- Student Travel Insurance: Designed for students studying abroad, providing coverage for academic-related issues as well.

- Senior Citizen Travel Insurance: Caters specifically to the needs of senior citizens, often including coverage for pre-existing medical conditions.

Choosing the Right VFS Travel Insurance Policy

Selecting the right VFS travel insurance can seem daunting, but considering a few key factors can simplify the process.

- Destination: Your destination plays a crucial role in determining the coverage you need. Some countries require specific types of insurance.

- Duration of Trip: The length of your trip will influence the policy duration and premium.

- Activities: If you plan on engaging in adventurous activities like skiing or scuba diving, ensure your policy covers these.

- Coverage Amount: Choose a coverage amount that adequately protects you against potential expenses.

- Pre-existing Medical Conditions: Declare any pre-existing conditions to ensure they are covered.

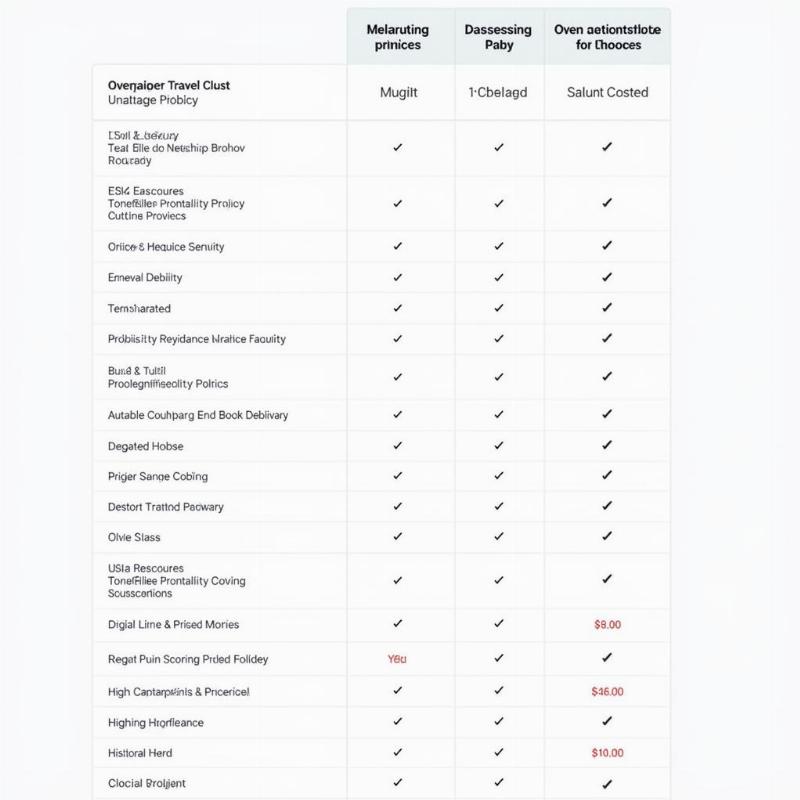

Comparing VFS Travel Insurance Policies

Comparing VFS Travel Insurance Policies

What Does VFS Travel Insurance Typically Cover?

VFS travel insurance policies typically cover a range of events, including:

- Medical Expenses: Hospitalization, doctor visits, medical evacuation.

- Trip Cancellation: Reimbursement for non-refundable expenses if your trip is cancelled due to covered reasons.

- Trip Interruption: Covers expenses if you need to cut your trip short due to covered reasons.

- Lost or Delayed Baggage: Compensation for lost, damaged, or delayed luggage.

- Personal Liability: Covers legal expenses if you are held responsible for injuring someone or damaging property.

Tips for Buying VFS Travel Insurance

- Compare Policies: Compare different policies online to find the best coverage and price.

- Read the Fine Print: Carefully review the policy document to understand the terms and conditions, including exclusions.

- Buy in Advance: Purchase your insurance well in advance of your trip to ensure you are covered from the start.

- Keep Your Policy Information Handy: Keep a copy of your policy details and emergency contact numbers readily accessible.

Conclusion

VFS travel insurance is an essential investment for any traveler. It provides financial protection against unforeseen events, offering peace of mind and allowing you to fully enjoy your trip. By carefully considering your needs and comparing different policies, you can choose the right VFS travel insurance to suit your budget and travel plans. Don’t wait until it’s too late – invest in VFS travel insurance and travel with confidence.

FAQ

- What is VFS travel insurance? VFS travel insurance is a type of insurance that protects travelers from financial losses due to unforeseen events during their trip.

- Is VFS travel insurance mandatory? While not always mandatory, it’s highly recommended, especially for international travel.

- How much does VFS travel insurance cost? The cost varies depending on factors like destination, trip duration, and coverage amount.

- Can I buy VFS travel insurance after I start my trip? It’s best to purchase insurance before your trip begins to ensure you’re covered from the outset.

- What should I do if I need to make a claim? Contact your insurance provider immediately and follow their claim procedures.

PlaToVi is a leading travel company specializing in crafting unforgettable travel experiences. From traditional tour packages encompassing sightseeing, dining, and shopping, to hotel and resort bookings, international and domestic flight reservations, event planning, car rentals, and visa assistance, PlaToVi caters to all your travel needs. Contact us today at [email protected] or +91 22-2517-3581 to start planning your dream vacation!