Travel GST rate is a crucial aspect of trip planning in India, impacting your overall budget. Whether you’re a domestic traveler exploring the diverse landscapes of India or an international visitor experiencing its rich culture, understanding how GST applies to your travel expenses is essential. This article will delve into the details of travel GST rates, covering various components like accommodation, transportation, and tour packages.

Decoding GST on Accommodation

When booking your stay, the GST rate on hotels in India varies depending on the tariff. For hotels charging less than ₹1,000 per night, there is no GST applicable. However, for hotels charging between ₹1,000 and ₹7,500, a 12% GST is levied. For tariffs above ₹7,500, the GST rate is 18%. This tiered structure ensures fairness across different budget categories. So, when comparing hotel prices, don’t forget to factor in the applicable GST.

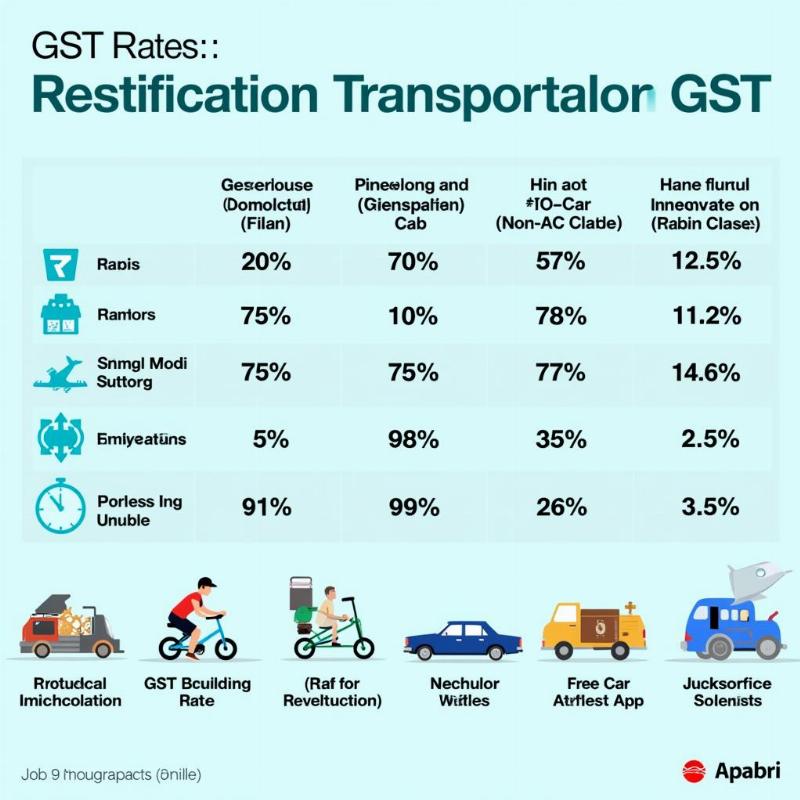

GST on Transportation: Flights, Trains, and Cabs

Transportation forms a significant part of travel expenses, and understanding the GST implications is crucial. Domestic flights are subject to a 5% GST on the base fare, while international flights are exempt. For train travel, the GST rate varies depending on the class of travel. AC class tickets attract a 5% GST, while non-AC classes are generally exempt. When it comes to cab services, the GST rate is typically 5%. Planning your transportation in advance and understanding these rates can help you optimize your travel budget.

GST on Transportation in India

GST on Transportation in India

GST on Tour Packages: Simplifying Your Travel

Tour packages often offer a convenient way to explore a destination, combining accommodation, transportation, and sightseeing. The GST rate on tour packages is typically 5%. This can simplify your budgeting process, as you have a single GST rate to consider for a bundled service. However, it’s always advisable to check the detailed breakup of the package cost to understand the GST component applied to individual services.

GST and Input Tax Credit for Travel Businesses

Businesses in the travel industry, such as travel agencies, can claim Input Tax Credit (ITC) on GST paid on their inputs. This helps reduce their overall tax liability and can translate to competitive pricing for consumers. Understanding how ITC works is vital for travel businesses to maximize their financial efficiency.

How to Start a Travel Agency Business in India?

If you are interested in starting a travel agency in India, understanding the travel GST rate is crucial. You can learn more about this process by checking out our guide on how to start a travel agency business.

Navigating GST on International Travel from India

For international travel booked from India, GST applies to the services provided within India, such as domestic travel arrangements. International flight tickets are generally exempt from GST. However, services like visa processing or travel insurance procured in India may attract GST. Understanding these nuances is crucial for managing your international travel budget.

Planning Your Travels with GST in Mind

By understanding the travel GST rate applicable to different components of your trip, you can plan your budget effectively and avoid any surprises. Whether you’re exploring the serene backwaters of Kerala or the bustling streets of Mumbai, being aware of the GST implications can make your travel experience smoother and more enjoyable.

Conclusion

Travel GST rate plays a significant role in your overall travel expenses in India. By understanding the applicable GST rates on accommodation, transportation, and tour packages, you can plan your budget more accurately. Whether you are a domestic traveler or an international visitor, knowing these rates is crucial for a smooth and financially savvy travel experience. Keep in mind these rates while planning your next trip!

FAQ

-

What is the GST rate on 5-star hotels in India? Hotels charging above ₹7,500 per night attract an 18% GST.

-

Is GST applicable to train tickets? AC class train tickets attract a 5% GST, while non-AC classes are generally exempt.

-

What is the GST on travel insurance bought in India? Travel insurance purchased in India is subject to GST, usually at 18%.

-

Do international flights attract GST? International flights departing from India are generally exempt from GST.

-

How can I find out the exact GST applied to my travel bookings? Always check the detailed invoice or booking confirmation provided by the service provider for a breakdown of the GST component.

-

Is there GST on travel kit pouch? The GST on a travel kit pouch would depend on its classification and the seller. Check with the retailer for specific information.

-

Are there any concessions on travel GST for senior citizens? Currently, there are no specific GST concessions for senior citizens on travel services.

PlaTovi, a leading travel company in India, offers a wide range of travel services, including traditional tour packages, hotel and resort bookings, domestic and international flight bookings, event planning, car rentals, and visa assistance. We aim to provide seamless and memorable travel experiences tailored to your needs. For further inquiries or to book your next adventure, contact us at [email protected] or call us at +91 22-2517-3581. Let PlaTovi help you plan your dream vacation today!