East West Travels share price is a topic that often piques the interest of investors, particularly those interested in the Indian travel and tourism sector. Understanding the factors influencing this share price can provide valuable insights for potential investors. This article will delve into the various elements affecting East West Travels share price, offering a comprehensive perspective for informed decision-making.

Decoding the Fluctuations: What Impacts East West Travels Share Price?

Several factors contribute to the dynamism of East West Travels share price. These range from company-specific performance indicators to broader economic trends and global events. Let’s explore some of the key influencers:

- Company Performance: The company’s financial health, profitability, and growth trajectory directly impact investor confidence and, consequently, its share price. Strong financial results often lead to a positive market reaction, while disappointing performance can trigger a decline.

- Industry Trends: The travel and tourism industry is susceptible to various trends, including changing travel patterns, economic downturns, and technological advancements. These trends can significantly influence the performance of companies like East West Travels and, in turn, their share price.

- Economic Conditions: The overall health of the Indian economy and global economic conditions play a crucial role in determining investor sentiment. Economic growth can boost travel spending and positively influence East West Travels share price, while economic downturns can have the opposite effect.

- Competition: The competitive landscape of the Indian travel market is constantly evolving. The presence of established players and the emergence of new competitors can impact East West Travels market share and profitability, influencing its share price.

- Government Policies and Regulations: Government regulations, tourism policies, and visa requirements can significantly affect the travel industry. Changes in these policies can either boost or hinder the performance of travel companies like East West Travels.

Investing in East West Travels: What You Need to Know

Before considering an investment in East West Travels, conducting thorough research and due diligence is essential. Understanding the company’s business model, financial performance, and future prospects is crucial for informed decision-making.

- Financial Analysis: Analyzing the company’s financial statements, including revenue, profitability, and debt levels, provides insights into its financial health and stability.

- Market Research: Understanding the competitive landscape and the company’s market share within the Indian travel industry helps assess its potential for growth and profitability.

- Management Evaluation: Assessing the company’s management team’s experience and expertise is vital for evaluating its ability to navigate challenges and capitalize on opportunities.

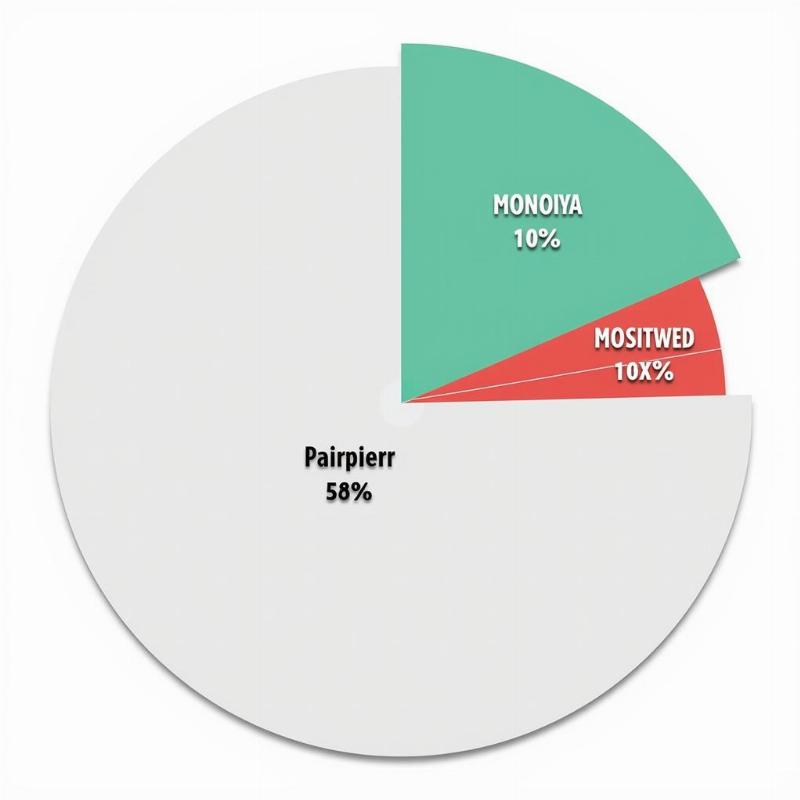

East West Travels Market Share in India

East West Travels Market Share in India

East West Travels Share Price: Long-Term Outlook

The long-term outlook for East West Travels share price is dependent on several factors, including the company’s ability to adapt to changing market dynamics, innovate its offerings, and maintain a competitive edge. The growth of the Indian travel and tourism sector and the overall economic climate will also play significant roles.

Is East West Travels a Good Investment?

Whether East West Travels is a good investment depends on individual investor risk tolerance, investment goals, and financial circumstances. Consulting with a financial advisor is recommended before making any investment decisions.

Conclusion

East West Travels share price is influenced by a complex interplay of factors. Understanding these factors and conducting thorough research is vital for making informed investment decisions. The Indian travel market’s dynamism and the company’s ability to adapt and innovate will ultimately determine its future success and its share price performance.

FAQ

- Where can I find real-time information on East West Travels share price? You can find real-time share price information on major financial websites and stock market platforms.

- What is the current market capitalization of East West Travels? The market capitalization varies and can be found on financial websites that track stock market data.

- Does East West Travels pay dividends? Dividend information can be found in the company’s financial reports and investor relations materials.

- What are the major risks associated with investing in East West Travels? Risks can include market volatility, competition, and economic downturns.

- Who are the main competitors of East West Travels? East West Travels faces competition from other established and emerging travel companies in India.

- How can I contact East West Travels investor relations? Contact information can be found on the company’s website.

- Where can I access East West Travels’ annual reports? Annual reports are typically available on the company’s investor relations section of their website.

PlaToVi, your trusted travel companion, specializes in crafting unforgettable travel experiences within India and beyond. From traditional tour packages to customized itineraries, we offer a wide array of services to cater to your travel needs. Whether you’re seeking a cultural immersion, a relaxing beach getaway, or an adventurous exploration, PlaToVi is here to make your travel dreams a reality. Contact us today to plan your next adventure! Email: [email protected], Phone: +91 22-2517-3581.